Start driving better conversations.

Novocall will be your new favorite business phone system.

Do you always go “arrrrgh” when you see your ARR? 😩

Recurring Revenue is extremely important to businesses because it keeps your business going. Literally.

Businesses should keep track of their Annual Recurring Revenue (ARR) because it helps increase your customer pool, improve sales, and drive you to make data-driven decisions.

But what exactly is ARR in SaaS and why is it so important? Let’s dive right into it!

Annual Recurring Revenue is a metric that helps companies project their expected recurring revenue year on year.

Mainly adopted by subscription or SaaS businesses, ARR gives companies the foresight to evaluate long-term revenue growth and business momentum to aid strategic-level decisions.

ARR is useful for both internal and external stakeholders for a variety of reasons:

You might have heard of the alternative metric to ARR, Monthly Recurring Revenue (MRR).

ARR takes into account the yearly total revenue that you will receive repeatedly, while MRR takes into account the monthly total revenue that you will receive repeatedly.

While they both appear similar, don’t be fooled into thinking that ARR is simply MRR x 12 (find our calculation below)! 😉

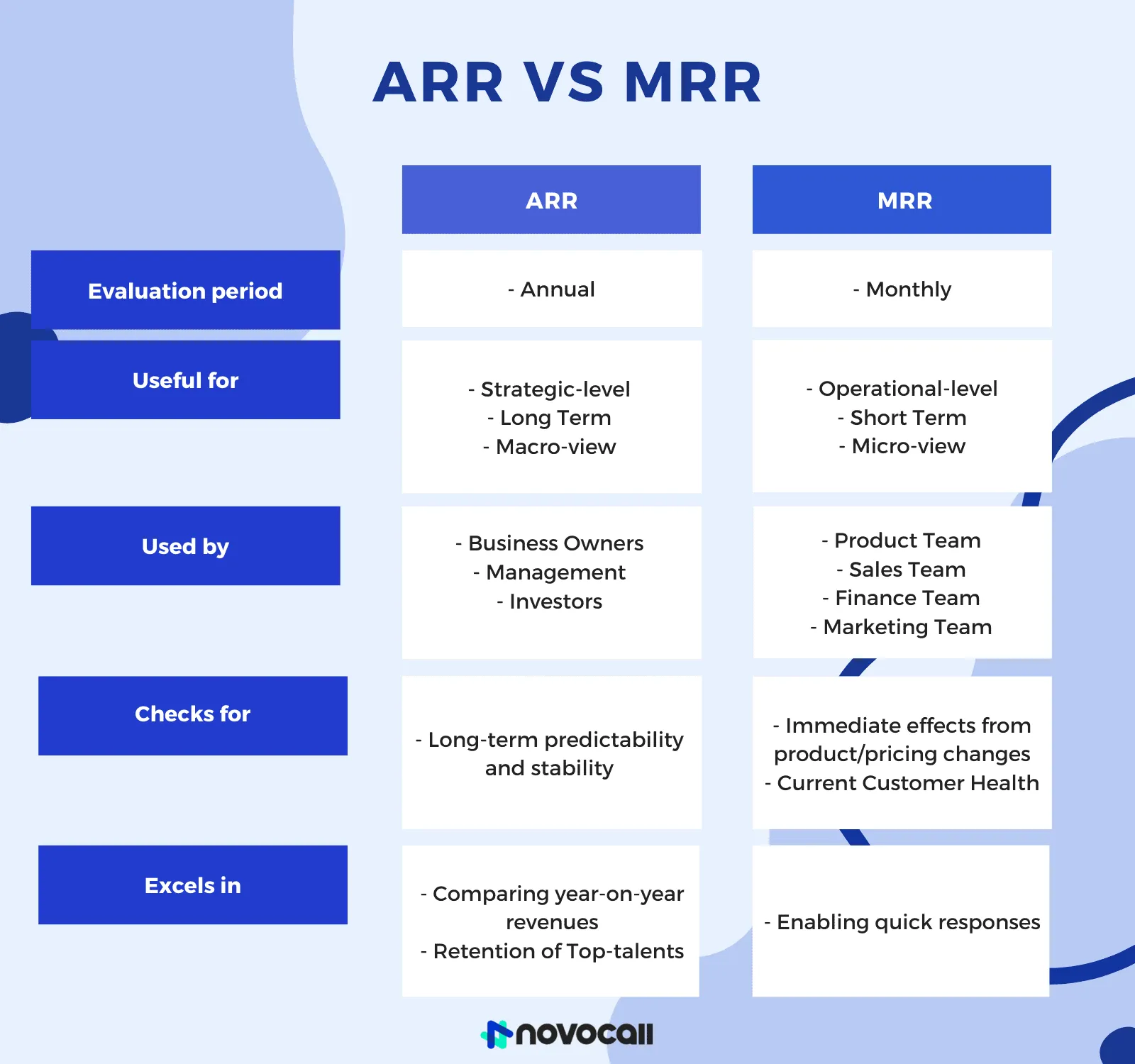

If you’re considering which metric to use, here’s a general overview to compare the two:

ARR accounts for yearly recurring revenue, so it’s more suitable for companies with multi-year contracts. That’s why ARR is predominantly used by B2B SaaS businesses with multi-year agreements. Businesses with lower transaction volume and high transaction value also turn to ARR.

MRR accounts for monthly recurring revenue, so it’s more suitable for contract terms that are less than a year. That’s why B2B or B2C subscription businesses with monthly subscriptions often use MRR.

ARR looks at yearly trends to assist in long-term predictions and checks for long-term stability. ARR’s broad overview also aids in identifying the top-performing talents in your company, so that you can focus efforts in retaining them. 😇

Meanwhile, MRR reflects the immediate effects from the changes you’ve made to your product or pricing strategy, enabling your team to make quick responses. MRR also informs you of your customer’s current health – if your customer isn’t doing well, it’s better to respond with a downgrade than to lose a customer altogether. 😯

Here’s a quick comparison table to summarize what we’ve just mentioned:

In essence, choosing to use ARR or MRR depends on:

Don’t forget, you can always use both ARR and MRR in your business! 😋

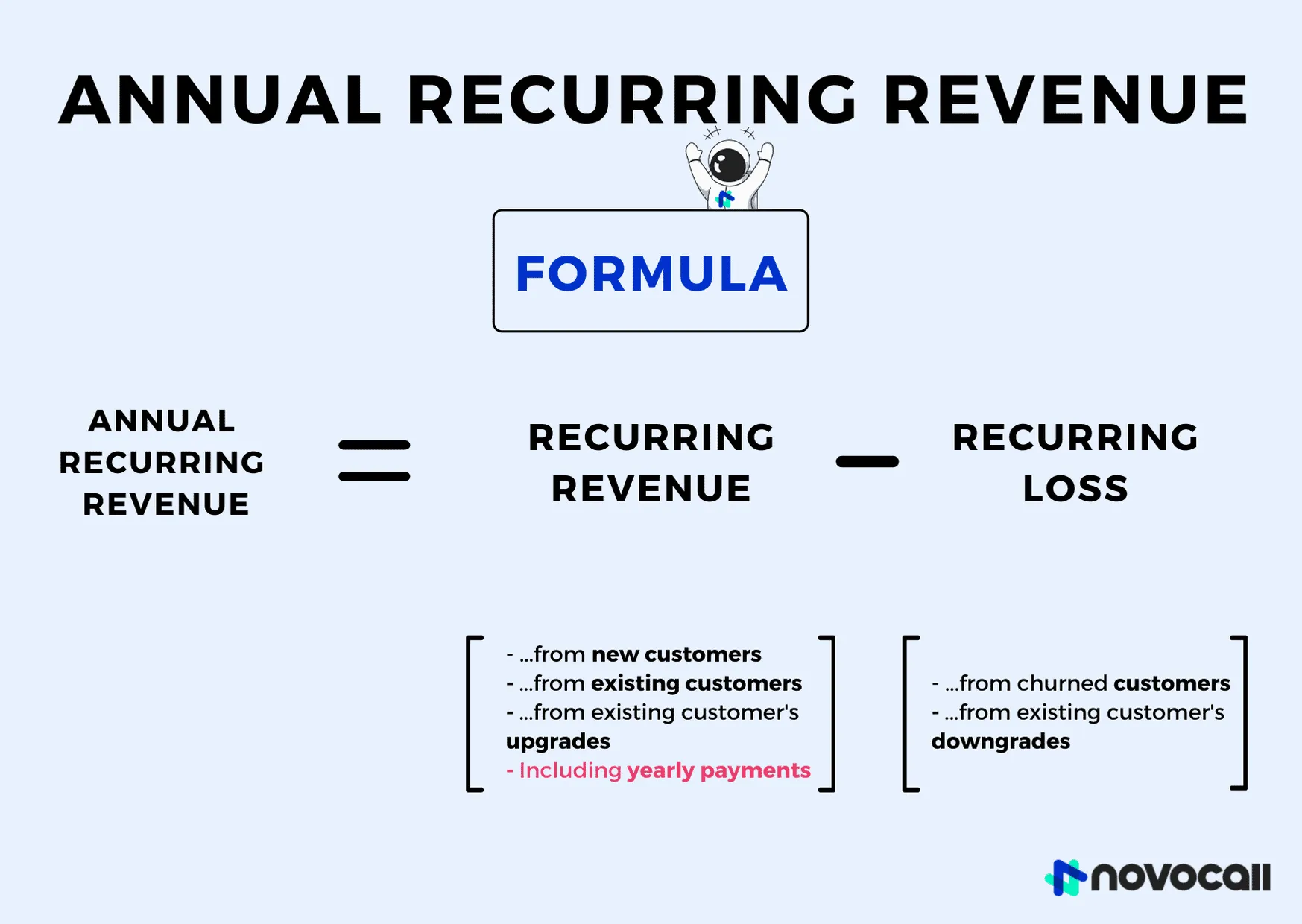

Now that you know what ARR is, let’s look at how to calculate it 👇👇👇

*Use annual figures

*Do note that when calculating ARR, you are assuming no changes to your customer base.

📍Remember to account for revenues on a yearly basis in your ARR.

*Use monthly figures

📍 Remember to account for revenues from discounted prices in your MRR.

💡 For both ARR and MRR, take note of the following:

✅ Account ONLY for recurring revenue/losses.

⛔ Do not include recurring Costs (you’ll confuse Revenue with Profitability😵).

⛔ Do not include one-time charges (e.g. one-time add-ons).

Now that you’ve calculated ARR…what can you do next?🤔

As we mentioned at the beginning, recurring revenue keeps your SaaS business going. With higher ARR (and MRR), your business will have more time to offer new products and services, which will in turn generate even more revenue. 😋

Here are three ways to increase your recurring revenue:

It comes as no surprise. Acquiring new customers = more sales = more ARR.

But how do you acquire new customers?

One obvious way is to improve your sales techniques. This could be trying to double down on your content marketing, automating your sales processes, and even trying a different approach when reaching out to new customers.

In fact, you could even lower your customer acquisition costs by making these changes to your sales processes.

Do not neglect your existing pool of customers. Lose them, and you will lose your recurring revenue.

It is almost always more costly to acquire new customers than to retain existing ones. A study shows that the probability of selling to an existing customer is 60 to 70%, while the probability of selling to a new prospect is 5 to 20%.

What a big difference! 😱

That’s because existing customers are more likely to repurchase from you when they are satisfied with your products or services.

So make sure to do regular check-ins and build genuine relationships with your existing pool of customers to improve customer satisfaction.

There’s always more recurring revenue to be generated from your existing customers with upgrades. Existing customers are 50% more likely to try new products and spend 31% more as compared to new customers.

With that in mind, if you notice them eyeing new features in the next tier, convince customers to upgrade to a higher tier. Show them how this jump can be value-adding to their business.

Even if they weren’t eyeing new features, you could always swoop in and do a quick check-in with them.

Notice that their business is growing quickly? How about checking out a better plan so you can scale up?

You don’t want to lose future recurring revenue from downgrades or churned customers, so carefully convince them of your product/service-customer fit.

That’s our simple introduction to what ARR is and how to calculate it!

It may seem daunting at first to gather all your data and have an honest review of your company’s growth. But once applied well, ARR can be a powerful enabler for you and your team. 🤩

We hope that this was helpful, subscribe to our blog below for more content like this! 👇👇👇

Yong Qing is a Content Marketer at Novocall. In his own time, he enjoys making music and philosophical conversations.

Discover more

Subscribe to our blog

Get insights & actionable advice read by thousands of professionals every week.