Start driving better conversations.

Novocall will be your new favorite business phone system.

Digital Marketing Executive

Even insurance agents are not insured against the rejections that come with cold calls.

However, let’s get one thing straight. Cold calling has worked, and still works for today’s insurance agents.

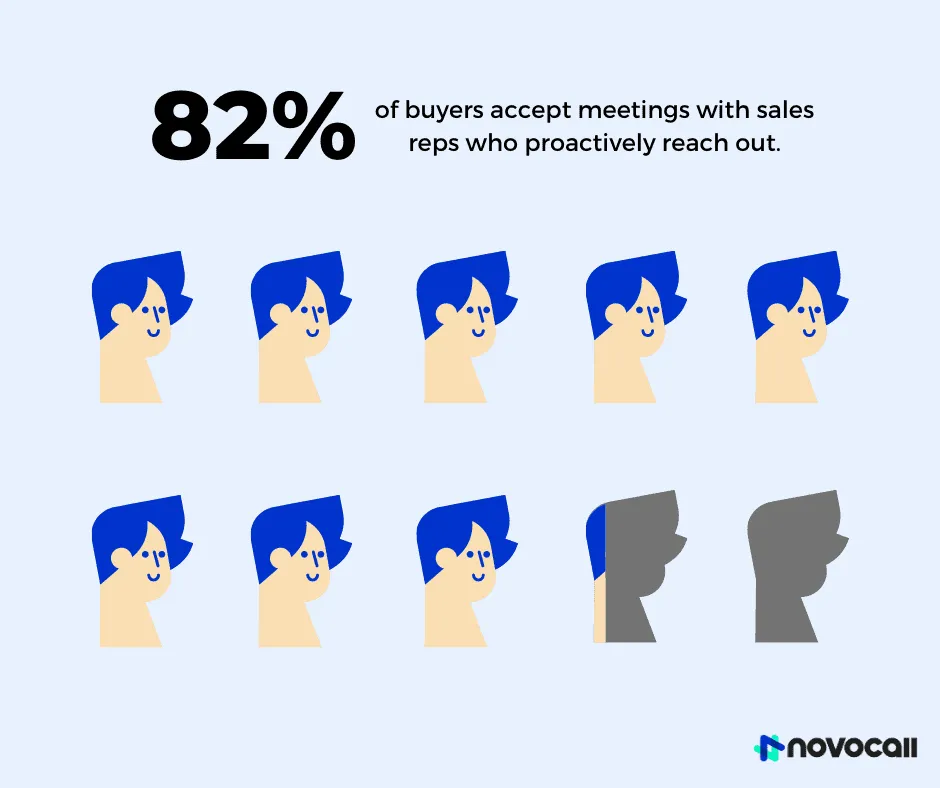

In fact, 82% of buyers accept meetings with reps who proactively reach out.

This doesn’t mean that outbound calling is easy, though. Quite the opposite in fact.

That’s why we’ve compiled a list of the best insurance cold call scripts. But before we start, let’s look at some important things that every cold call should have.

It’s normal for companies to use success stories to show potential customers that their product or service works. SaaS companies like ourselves do it all the time.

Check out our case studies page as a reference.

If companies use their success stories to promote themselves, we don’t see why you shouldn’t follow suit! Mentioning one or two big deals successfully closed, or how one of your clients has benefited from your investment policies can go a long way in positioning yourself as the trustworthy go-to agent. So prepare one or two of these stories in your script!

Of course, you don’t want to end up being the arrogant show-off. This brings us to our next point.

No one likes a show-off. In your cold calls, don’t overly focus on how great you are. Remember, the prospects are always the stars of the show. Make the call about them.

Be genuine in finding out about their pain points. Ask them what type of policies they currently have. Ask them how they are benefitting from their policies. Ask them if they are achieving what they want with their existing policies. Show that you care.

Engage in active listening when speaking to your prospects and never ever pass judgment over anything they say.

Keeping these 3 points in mind, let’s move on to 8 of the best insurance cold call scripts we crafted for you.

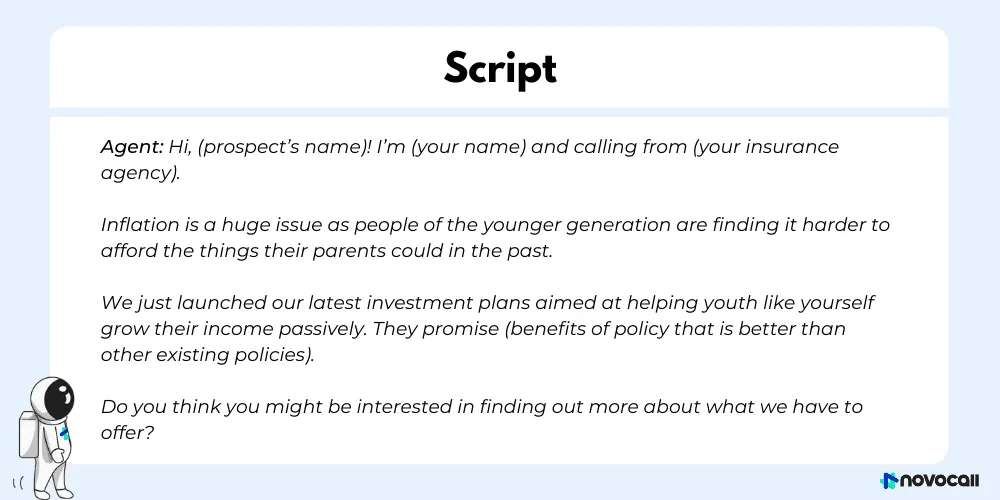

You don’t always get a lot of time to pitch to your prospects. People are busy and oftentimes, you need to get straight to the point within the span of a minute or two.

You can make use of the elevator pitch format to quickly introduce yourself and present what you have to offer. As its name suggests, the pitch should last around the duration of an elevator ride. That’s approximately 30 seconds to 2 minutes.

Your pitch should include these parts: an engaging opening to draw your prospects in, addressing the problems your prospects are facing, what you can offer to them, as well as how your policies are better than their existing ones.

Now let’s examine this script to see how it achieves the aforementioned criteria:

Of course, this script is tailored for insurance agents selling investment plans to young people. You can tailor it based on the type of policies you are selling and your target audience.

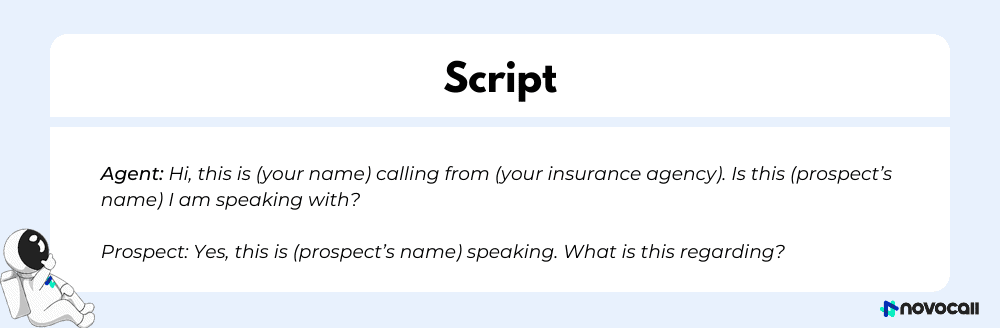

The end goal of your cold calls isn’t always to sell something. Sometimes, it’s better to establish good rapport with your prospects first. And one of the ways to do so, is to provide them with freebies such as free quotations

Position your pitch in a way that makes them feel:

Now, offer the free quote and use it as a hook to quickly engage the prospect.

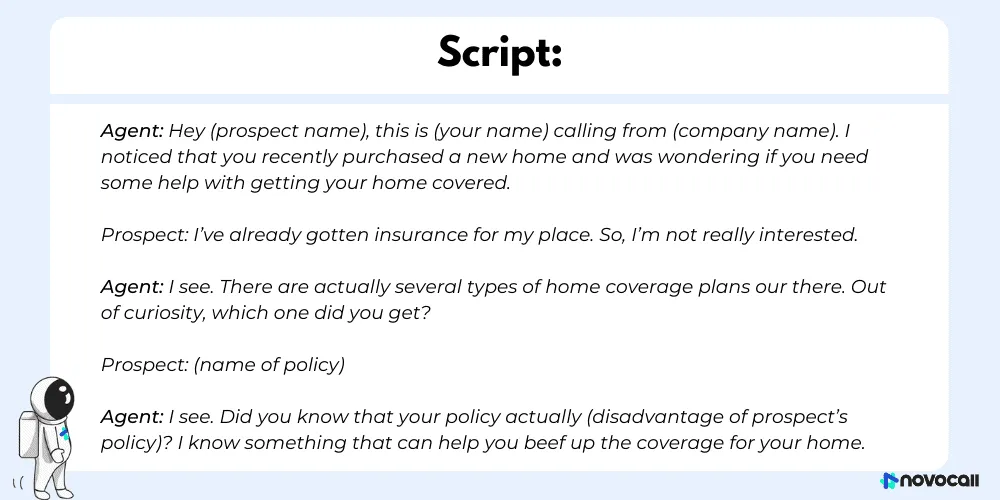

An insurance policy is one of those things that is considered a commodity, a must-have of sorts.

Most of the time, the people you are reaching out to already have insurance policies. How then can you still sell to them? Or should this even be a focus?

If the prospect already has a policy and is insistent on not buying another one, accept the rejection. But this doesn’t mean that the call was for nothing.

Make use of the opportunity to build a strong connection with the prospect. In the future, these prospects may just think of you when they happen to need a new one, or when someone they know is looking for one.

If the prospect rejects you, just thank them nicely. Thank them for their time and leave your contact.

Assure them that you are there to provide a free consultation if they ever need it. Even if the policy they own was not brought from you.

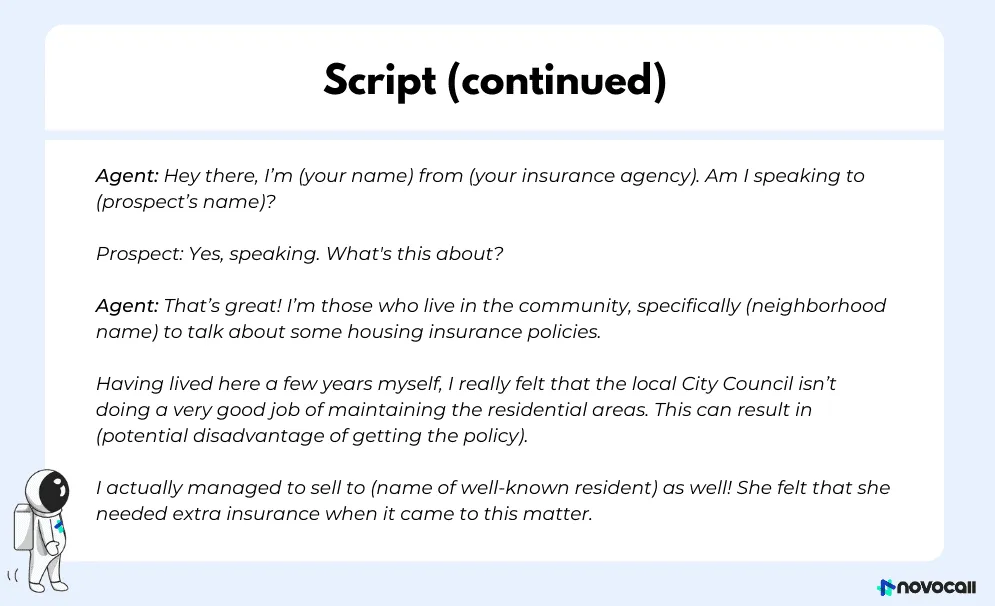

People are more likely to trust you if they know you belong to their community.

In this scenario, your script should include:

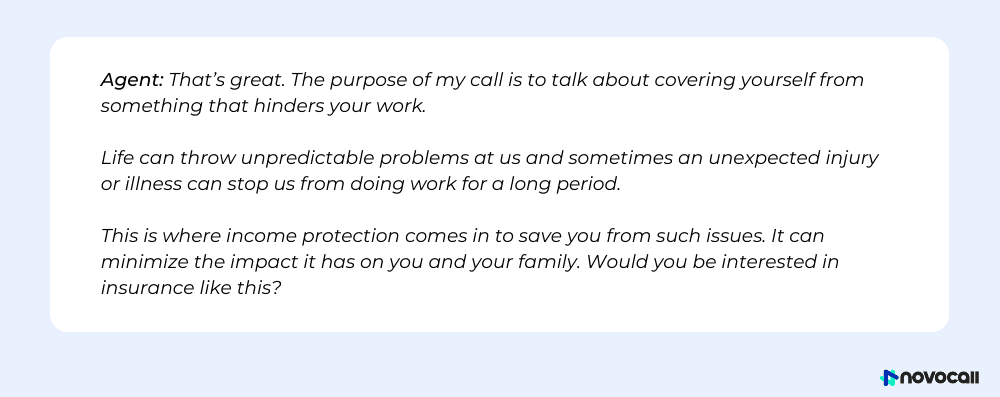

No doubt, it is harder to sell some insurance plans as compared to others. While a lot of people see a value in your life insurance plans, they might not see a value in your offers regarding travel or income protection.

Let’s take a look at a hard to sell insurance plan:

Now you should mention your purpose of calling – make it simple and clear.

The prospect might raise some objections but you should be ready to address them.

If they show no objections, schedule a consultation for them as per their schedule.

If they don’t agree to a consultation, don’t pressurize them. Make a note of them as a cold lead in your CRM and follow up with them in a month or two.

When you’re making a cold call, there’s a high chance you’re calling a prospect when they’re in the middle of something.

The key aspect here is to get your main point across as quickly as possible while also making sure to get the prospect’s information to follow up with them later on.

You could first start by introducing yourself, as usual. The prospect could possibly interrupt you to say that they’re busy at the moment. Don’t be phased, this is pretty normal when they’re in a hurry.

You could continue with:

Give them some time to respond. We’ve crafted 2 scripts according to what their response could be.

You get your main point across within two sentences, and you still get their email address as a means of communication without taking too much of their time.

After they’ve given you their email, be sure to follow up with them ASAP so that they don’t forget about the conversation you just had.

Make sure to take note of this in your CRM and follow up with them again.

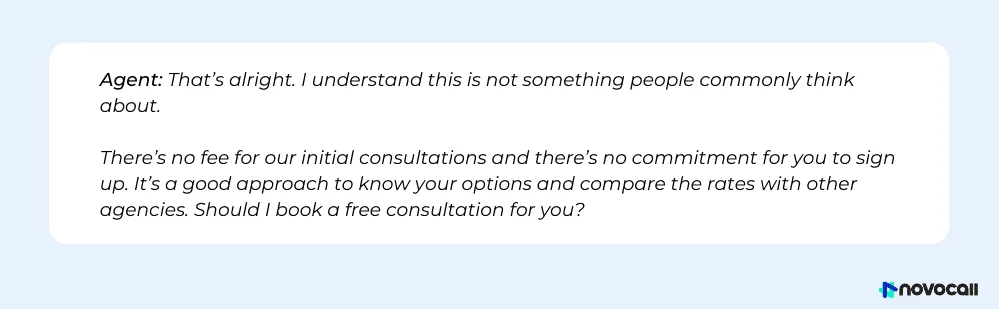

Just because your prospect shows interest in purchasing a policy doesn’t necessarily mean they‘ll buy it straight away. As insurance plans are high-value products, it’s common to still have to nurture prospects before they decide to buy.

Here’s a script you can follow:

It’s important to reassure them that for any savings plans they’re going for, they’re still able to save with what they have currently. If they’re going to break their bank to save for the future, what’s the point then?

Again, once they’ve given you their email address, quickly send over the necessary documents for them to browse through. You don’t want them to forget about this and lose interest!

After a few days, drop them a call again to follow up.

If you have a competitive price bracket, you could use this as a way to get your prospects hooked to the call.

After all, no one likes paying for anything more than they should, especially if they can get it at a better price.

If the prospect shows interest, ask them what policies they currently have that you’re able to offer a better price for. You can then focus on the particular features of your policy that make it better than your competitors.

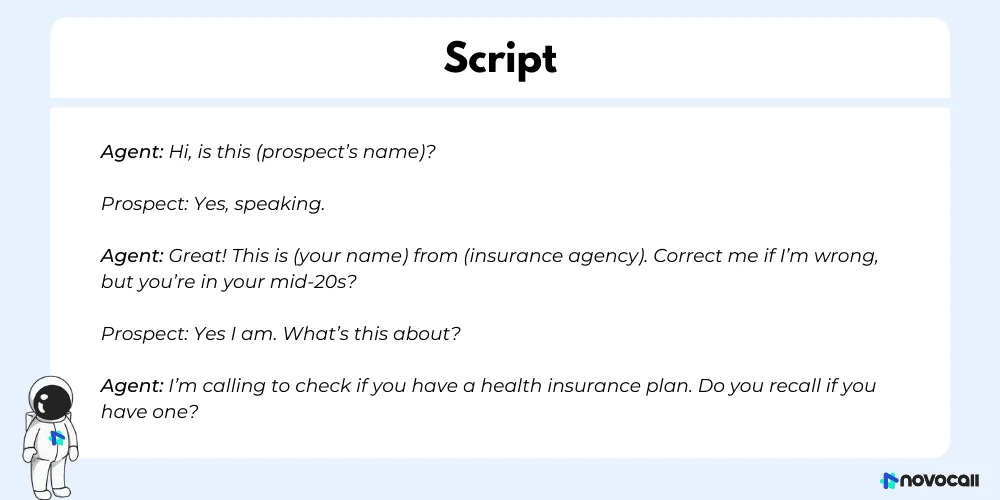

When trying to sell health insurance, age plays an important role.

Prospects in the early stages of their life wouldn’t consider purchasing a health insurance plan for one simple reason – they’re still young. It just isn’t their priority.

So how do you pitch to someone who’s in their mid-20s to 30s?

The key here is to dial down the upfront costs and dial up the long term benefits.

Here’s a script you could follow:

If the prospect agrees, you can share the different plans and coverage that each plan provides.

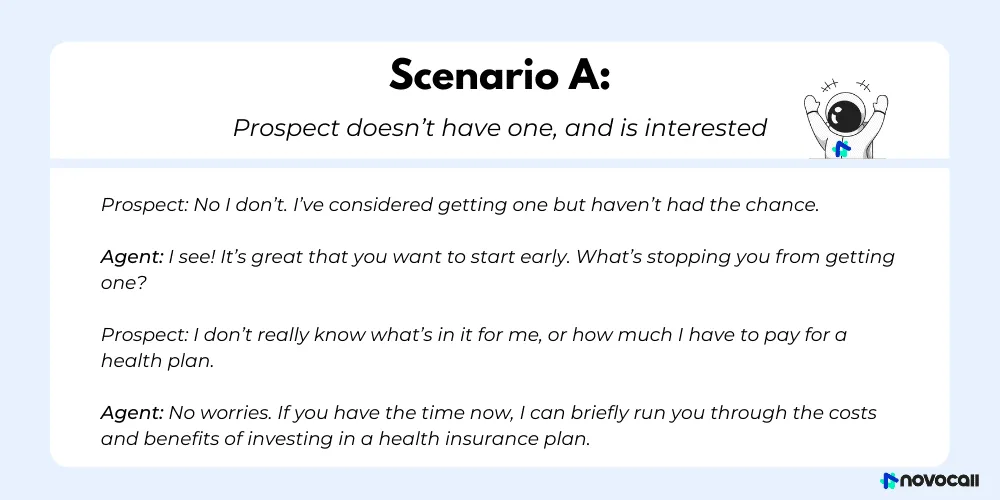

However, it’s important to note that it is rare for a young person to want to buy health insurance. But don’t worry, we have a script for when situations like these arise:

See how we managed to tie in “low price” with “maximum benefit”?

It’s also important to mention that health insurance policies are the most worth it to get when you’re young. You can then use this to gauge their interest in getting a health policy

Even with a good script for every possible scenario, you’ll still experience rejection. That’s just the nature of cold calls. But you should be able to see improvements simply by handling different situations differently.

To ensure that your scripts are effective, monitor the performance of your agents through in-depth reports from the dashboard. You can easily do this with holistic call management phone systems, take for example Novocall, which helps you automate your outbound calls.

Another measurement to consider is whether you get referrals from a cold call. Sure, you didn’t connect on the first call, but getting a referral from someone who’s not interested is still a win.

And of course, watch your sales numbers. With a few good cold calling scripts, those figures are sure to rise at least a little bit. If they don’t, review your text with a trusted colleague to try to improve it.

However, if you find that the endless cold calls still aren’t working, don’t be disheartened! You can reach out to your clients via other methods, such as through chat marketing and using insurance message templates.

While we’ve prepared insurance cold call scripts for many different scenarios, the possibilities are endless.

It’s important that you remain flexible and adjust the script depending on the situation you’re in. Also, test out different scripts to see which works best, and once you’ve found the one, stick to it.

Make sure you don’t skimp on the practice too – after all, practice makes perfect.

If you need more help, check out some cold call tips we have on our blog!

Nigel is a Digital Marketing Executive at Novocall where he specializes in SEO. Prior to this, he had written for several SaaS companies including Workstream and the now defunct Hatchme. In his free time, he engages in strength training and is a lover of languages.

Discover more

Subscribe to our blog

Get insights & actionable advice read by thousands of professionals every week.